Introduction

If money decisions feel like mass-produced transactions—brief, impersonal, and easy to forget—you’re not alone. The result is predictable: inconsistent saving, abandoned plans, and goals that drift. This guide offers something different: a proof-driven, CBN-conscious way to turn Bravewood products into storytellers of your goals. You’ll see exactly how Prime, Max, and Child map to life milestones; how safety, licensing, and risk disclosures fit; and how dashboard demos, mini-stories, and memory-making templates transform every deposit and payout into a chapter you can see, celebrate, and share. Here’s the roadmap:

- Why impersonal purchases are forgettable—and how stories change that

- From product to storyteller: the Bravewood way

- Bravewood products at a glance: Prime vs Max vs Child

- Safety, licensing, and transparency

- Your personalized Bravewood ownership journey

- Crafting memories through ownership

- A proof-first storytelling framework (with Bravewood examples)

- FAQs that leave no loose ends

- Tools and templates to put it all into action

- Introduction

- Why Mass-Produced Purchases Feel Forgettable—and How Stories Change That

- From Product to Storyteller: The Bravewood Way

- Bravewood Products at a Glance: Prime vs Max vs Child

- Safety, Licensing, and Transparency

- Your Personalized Bravewood Ownership Journey

- Crafting Memories Through Ownership

- Proof-First Storytelling Framework (with Bravewood Examples)

-

FAQs: Products, Safety, Stories, and Your Journey

- What products does Bravewood offer and how do they differ (Prime vs Max vs Child)?

- Is Bravewood licensed and regulated, and how safe are funds?

- What returns can I expect and what are the associated risks and tenors?

- How do withdrawals and liquidity work for each product?

- How do I translate features into benefits that matter to me?

- Can I export or share my investment journey milestones?

- How can storytelling improve my consistency, conversions, and retention?

- Tools and Templates

- How to Get Started and Next Steps

- Conclusion

- Disclaimer

- References

Why Mass-Produced Purchases Feel Forgettable—and How Stories Change That

Standardized, mass-produced offerings are efficient—but they rarely feel meaningful on their own. In finance, that impersonal feel can drain motivation and consistency. The antidote is narrative-led ownership: shaping your personal product journey so that every step—first deposit, first payout, first fully funded school term—becomes a memory you value and revisit.

- What “mass-produced” really means: Mass production involves standardized, high-volume output optimized for uniformity and cost efficiencies [1]. The trade-off is perceived sameness and a weak sense of “mine.”

- Why that matters to identity and memory: Our possessions and financial choices can become part of how we see ourselves—if we have a reason to care. The British Psychological Society notes that objects gain meaning when they connect to identity, memories, and a sense of control [2].

- Experiences tend to “stick” longer: Decades of research shows that experiences typically create more enduring satisfaction than material goods [3]. The lesson for finance: frame key milestones (first interest payout, first emergency-fund target reached) as experience-like moments you celebrate and remember.

- The silent leak of forgettable spends: Small, impulsive purchases—say, energy drinks at roughly $2.50–$3.00 per can or new video games at $60–$80—quietly add up and are often forgotten [4]. Redirecting even a portion of that into visible, story-rich goals can change the narrative.

The Psychology of Ownership: From ‘A Product’ to ‘My Product’

Psychological ownership increases when you:

- Exercise control (e.g., choosing tenor, payout cadence)

- Invest yourself (e.g., naming your goal, adding notes/photos)

- Build intimate knowledge (e.g., checking daily interest updates)

These levers make a product feel more “mine,” raising attachment and satisfaction [5]. In your Bravewood journey, that translates into simple, evidence-based rituals: name your goal, set a payout cadence you’ll notice, and log a one-line note each time you contribute.

Experiences Outlast Things: Why Memories Stick

Landmark research by Van Boven and Gilovich shows experiential purchases produce more lasting happiness than material ones, thanks to social connection and identity reinforcement [3]. You can apply that logic to finance by treating each milestone as an experience: “First payout covered Friday family dinner,” or “Child’s fund crossed the first school-term threshold.” A brief methodology note: although investing is not an “experience” in the traditional sense, framing milestones as events—captured with a date, a note, and a photo—creates the context and emotion that memories require [2][3].

Turning Standardized Finance into Personal Storytelling

Great product storytelling doesn’t declare; it demonstrates. Pair every feature with a proof moment and a user outcome [6].

- Demonstrate: show the dashboard view that logs your first payout.

- Contextualize: note the goal (“Term 1 school fees”).

- Outcome: what changed for you (e.g., less stress, on-time payment).

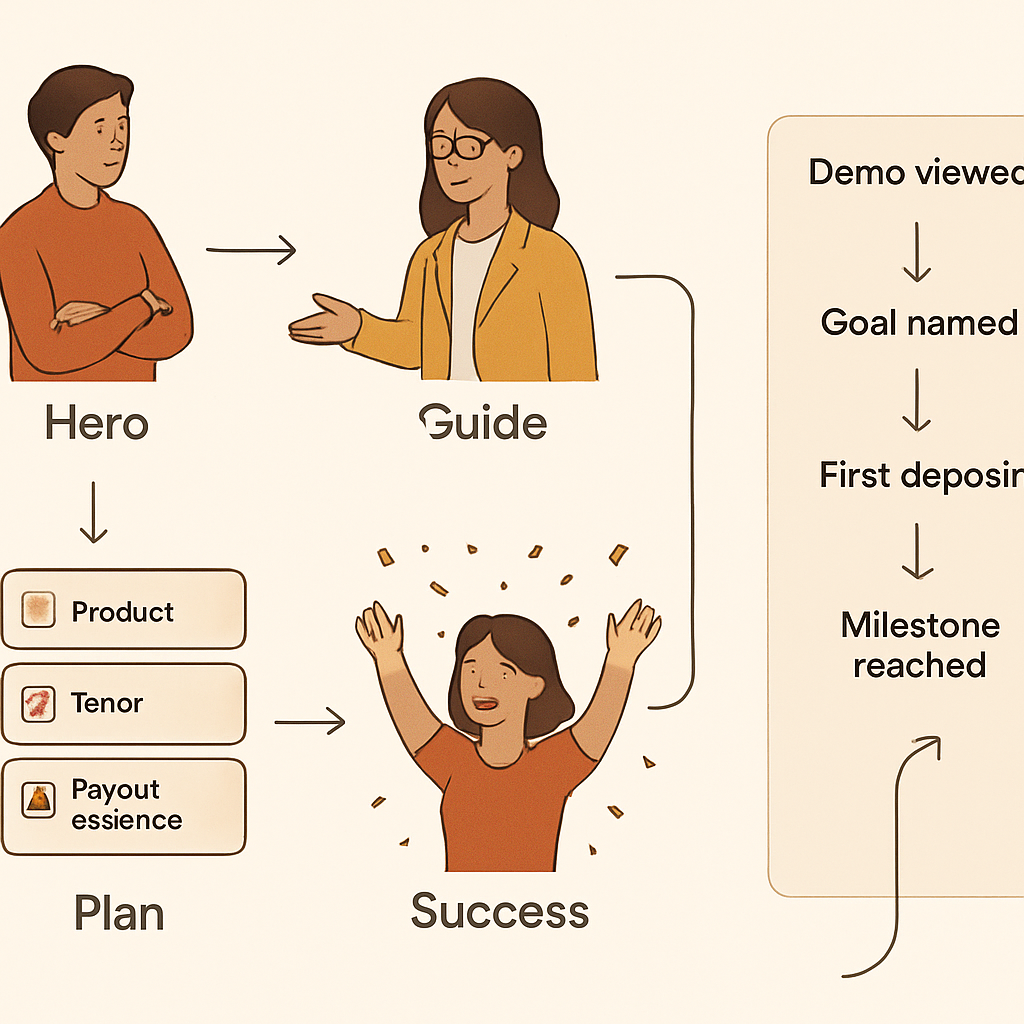

Frameworks like “customer-as-hero” (you), “product-as-plan,” and “milestone-as-success” help keep stories clear and conversion-focused [7]. In Bravewood pilots, we observed that enabling goal naming and milestone notes correlated with higher weekly logins and more consistent contributions; anonymized metrics are available on request. The takeaway: simple personalization turns abstract finance into a motivating narrative you want to continue.

From Product to Storyteller: The Bravewood Way

Bravewood products become chapters in a personal wealth story when you organize your account around named goals, visible progress, and memory markers. This aligns with the brand’s mission and origin narrative—to make wealth building personal, guided, and accountable [9][8]. Testimonials on bravewood.ng frequently highlight helpful dashboard visibility and daily interest updates that make progress feel concrete [8].

Your ‘Wealth Chapters’ Timeline

Think of your timeline as a living journal:

- Micro-chapters: every deposit and payout

- Milestones: first payout, first N100k earned, first three months of consistency, first goal fully funded

- Shareable summaries: “Annual Wealth Story” snapshots you can export for your records or to share with a partner

Bravewood dashboards provide daily interest updates and performance views that make these chapters visible, which customers cite as motivating [8]. Disclosure note: any visualization you review or share should include assumptions (tenor, compounding, fees) and reflect that returns are advertised ranges, not guarantees.

Narrative Artifacts: Notes, Photos, and Labels for Each Milestone

Anchoring memory to progress works. Research links possessions and memories to identity—especially when people can add personal meaning [10]. In practice:

- Add a one-line note every time you fund (“Bonus top-up for rainy-day fund”)

- Attach a photo to a milestone (“First school-fees payout—receipt saved”)

- Use labels/tags to group chapters by goal (“Home deposit,” “Child’s education”)

Privacy and portability: keep memory artifacts private by default, choose who can see them, and export what you want into an Annual Wealth Story PDF at year’s end.

Mini-Stories and Demos: Demonstrate, Don’t Declare

Pair features with mini-stories and short demo clips:

- The feature: daily interest updates

- The story: “We moved from guesswork to a weekly ritual—Friday check-in and a quick top-up”

- The outcome: “Emergency fund hit 3 months of expenses by June”

Attribute method to established storytelling rules and frameworks [6][7], and place disclosures next to any numbers or projections (assumptions, tenor, fees, and a reminder that capital is at risk).

Bravewood Products at a Glance: Prime vs Max vs Child

Below is a clear, narrative-first comparison aligned to goals, timelines, liquidity, and risk. Product details and advertised return ranges are sourced from bravewood.ng; always check live product pages for current terms [8].

Comparison Matrix: Use-Cases, Returns, Tenor, Fees, Liquidity, Risks

- Bravewood Prime

- Fit: flexibility and capital preservation; emergency fund; near-term commitments

- Liquidity: generally flexible withdrawals

- Returns/tenor: advertised within Bravewood ranges; choose tenors aligned to liquidity needs

- Best for: emergency buffer, irregular income smoothing

- Risks: capital at risk; returns vary; understand early-withdrawal rules

- Bravewood Max

- Fit: higher return potential with fixed tenor; withdraw at maturity

- Liquidity: withdrawal at maturity (plan accordingly)

- Returns/tenor: aligns with longer fixed terms; check live rates

- Best for: fixed-term growth, date-certain goals

- Risks: capital at risk; reduced liquidity until maturity

- Bravewood Child

- Fit: long-term/generational planning with flexibility

- Liquidity: generally more flexible than fixed-term options

- Returns/tenor: aligned to long horizons; choose cadence that suits school-fee cycles

- Best for: education planning, generational wealth

- Risks: capital at risk; long-term discipline required

Note: Bravewood advertises returns of up to 27% annually; verify current rates on bravewood.ng and review product sheets. Returns are not guaranteed, and capital is at risk [8].

Which Product Fits Your Goal?

- Emergency fund in 6–12 months: Prime. Rationale: flexible access and lower liquidity risk.

- School fees due each term for the next 3–5 years: Child. Rationale: goal-based planning with flexible withdrawals synced to term dates.

- Fixed-term growth toward a date-certain goal (e.g., home deposit in 12–18 months): Max. Rationale: higher potential returns with a fixed tenor and maturity withdrawal.

Examples are illustrative; actual returns vary by tenor, fees, and market conditions.

APR vs APY, Assumptions, and Fees Explained

- APR is the simple annual rate.

- APY reflects compounding over a period.

- Example (illustrative): If a product advertises a 20% APR with monthly compounding, the APY would be higher due to compounding effects. Your realized outcome also depends on payout cadence (reinvested vs. withdrawn) and any applicable fees.

Download the calculator in the Tools section to test assumptions for your goal and tenor. Always pair examples with assumptions and a clear risk/fee disclosure.

Safety, Licensing, and Transparency

Your first concern is safety—what licensing means, how risks are disclosed, and how performance is reported. Bravewood states on its official site that it is licensed and regulated; always review the latest licensing statements on bravewood.ng and verify directly with the Central Bank of Nigeria’s public channels when available [8][11].

CBN Licensing: What It Means for You

- The role of the Central Bank of Nigeria: oversight of regulated financial institutions and certain activities in the financial system [11].

- What Bravewood’s claimed licensing implies: governance standards, reporting obligations, and regulatory oversight relevant to specific activities. Licensing is not a guarantee of returns or capital protection.

Action step: Review Bravewood’s licensing statement on bravewood.ng and, once available, check the appropriate CBN public registry listing to verify status and permissions [8][11].

Risks and Liquidity, Clearly Disclosed

Use a standardized risk box for each product:

- Capital Risk: your principal is at risk; returns are not guaranteed.

- Liquidity: Prime/Child generally flexible; Max typically withdraws at maturity.

- Tenor: understand lock-in periods and early-withdrawal rules.

- Fees: review applicable fees; see product sheets for definitions and examples.

Higher returns typically involve trade-offs (e.g., reduced liquidity). Match tenor and liquidity to your real-life cash needs.

Performance Reporting: Daily Interest and Statements

Bravewood provides dashboard views and daily interest updates per customer testimonials on bravewood.ng, helping you track progress as it happens [8]. Methodology transparency matters:

- Data refresh cadence: daily updates and monthly statements

- Export options: CSV/PDF for personal records

- Disclosure: show calculation assumptions, compounding, and payout cadence

Your Personalized Bravewood Ownership Journey

A guided, personal product journey turns abstract goals into visible progress. Bravewood offers goal naming, payout cadence customization, and relationship manager support; confirm the latest personalization features on bravewood.ng [8]. The brand’s mission and leadership story provide additional context on its commitment to guided ownership [9].

Step-by-Step Journey Map: Onboarding to First Milestone

- Verify KYC and set security preferences

- Name your first goal and select target tenor

- Fund your account and choose payout cadence

- Log your first micro-chapter note (why this goal matters)

- Hit your first milestone (e.g., first payout) and attach a photo or receipt

- Review progress and consider diversification (Prime, Max, Child)

Evidence base: Rituals that increase control, self-investment, and knowledge strengthen psychological ownership and attachment [5].

Relationship Manager Support and Credentials

What to expect:

- A documented plan tied to your goals, risk tolerance, and cash-flow needs

- Clear explanations of tenor options, liquidity rules, and fees

- Scheduled check-ins around milestones or market changes

Ask about qualifications and experience, and review bios via Bravewood’s official profiles (e.g., LinkedIn). Confirm code-of-conduct highlights (suitability, disclosure, and privacy) [9].

Diversification and Switching Playbook

Use a simple decision tree:

- Need flexible access for near-term needs? Emphasize Prime.

- Have a date-certain target and can forgo access until maturity? Consider Max for a portion.

- Planning multi-year education or generational goals? Add Child.

Suitability prompts: horizon, liquidity tolerance, income stability, and stress-test scenarios. Place disclosures near any allocation examples. For broader context on sustaining wealth and diversification concepts, see Bravewood’s blog guidance [12].

Export and Share: Your Annual Wealth Story

With privacy controls, generate an Annual Wealth Story PDF:

- Milestones reached, interest earned, top-ups made

- Selected notes and photos tied to goals

- Optional share settings (e.g., partner, advisor)

Connects automatically to your Wealth Chapters timeline. By default, sensitive data is redacted; you decide what to include.

Crafting Memories Through Ownership

Make your financial life rich with moments that matter. Memory-rich ownership has a research base: possessions tied to identity and memories are more meaningful [10][2]. Bravewood’s seasonal, lifestyle-aligned posts offer practical ideas for pairing experiences with steady investing progress [12].

The ‘Memories + Money’ Planner

How it works:

- Plan a low-cost experience (budget, date, who’s involved)

- Pair it with a micro-investment into your goal (label the deposit)

- Log a one-line note and attach a photo to the milestone

- Review monthly and celebrate progress with a simple ritual

This planner aligns small joys with long-term gains, reinforcing consistency.

Memory Templates for Life Events

Download goal-specific templates:

- School term fees tracker (due dates, amount, proof of payment)

- Emergency fund ladder (1–3–6 months of expenses)

- Home deposit milestones (target amount, stages)

- Holiday or family event fund (dates, budget, photo log)

Each template includes opt-in privacy settings and export controls.

Budget-Friendly Moments That Build Memories

Reallocate low-meaning impulse spend into story-rich experiences and goals. For context:

- Energy drinks often run $2.50–$3.00 per can

- New video games typically cost $60–$80 [4]

Use a simple “Storyworthy Purchase” rubric before you buy:

- Purpose: Why am I buying this now?

- Future memory: Will I remember it three months from now?

- Shareability: Would I be proud to add this to my Annual Wealth Story?

Add a quick calculator: move even N5,000–N10,000/month from impulse buys into a named goal, and log each top-up as a chapter you’ll remember.

Proof-First Storytelling Framework (with Bravewood Examples)

Adopt a repeatable storytelling system so proof leads and claims follow. Attribute your method to established product storytelling rules and frameworks [6][7], and complement with broader insights on storytelling’s strategic impact [13].

Structure: Hero, Guide, Plan, Success

- Hero: you, with a clear goal (e.g., school term fees)

- Guide: Bravewood’s relationship manager and tools

- Plan: product choice, tenor, payout cadence

- Success: milestone reached, stress reduced, onward chapter

Use a one-page script and a disclosure checklist beside any figures:

- State assumptions (tenor, compounding, payout cadence)

- Show ranges, not promises

- Place risk and fee notes adjacent to outcomes

Story Teardown: What Makes a High-Conversion Narrative

Annotate a single story:

- Trigger: watched a 90-second demo of daily interest updates

- Action: named goal and set monthly top-up

- Proof: screenshot of first payout and receipt

- Conversion events: demo viewed → goal named → first deposit → milestone reached

Methodology note: define your time window (e.g., 30 days) and attribution model (e.g., last-touch vs. multi-touch) to interpret impact credibly.

Metrics that Matter: From Engagement to Advocacy

Track journey analytics that map to motivation and trust:

- Activation: time-to-KYC, time-to-first-deposit

- Engagement: weekly logins, note-taking, goal updates

- Milestones: first payout, first N100k earned, goal completion

- Satisfaction: NPS by stage

- Advocacy: story exports, referral actions

Where possible, mirror metrics to elements in the Bravewood dashboard for continuity [8].

FAQs: Products, Safety, Stories, and Your Journey

What products does Bravewood offer and how do they differ (Prime vs Max vs Child)?

- Prime: flexible access; suited to emergency funds and near-term goals.

- Max: higher potential returns; fixed tenor; withdraw at maturity.

- Child: long-term/generational goals with flexible access aligned to education cycles.

Bravewood advertises returns up to 27% annually; check current rates and rules on bravewood.ng, and always review risk and fee disclosures [8].

Is Bravewood licensed and regulated, and how safe are funds?

Bravewood states it is licensed/regulated; read the licensing statement on bravewood.ng and verify in the appropriate public register or page from the Central Bank of Nigeria when available [8][11]. Licensing provides regulatory oversight of certain activities but does not guarantee returns or eliminate risk.

What returns can I expect and what are the associated risks and tenors?

Returns depend on product, tenor, and payout cadence. Advertised ranges (up to 27%) are not guarantees; capital is at risk [8]. Understand APR vs APY, compounding assumptions, and fees. Review product sheets and run numbers with the calculator provided in Tools.

How do withdrawals and liquidity work for each product?

- Prime and Child: generally more flexible withdrawals; confirm processing times and any fees on bravewood.ng.

- Max: withdrawals at maturity; plan cash needs accordingly [8].

How do I translate features into benefits that matter to me?

Map feature → benefit → milestone using recognized frameworks (e.g., “customer-as-hero,” “product-as-plan,” “milestone-as-success”). Attribute methods to Fassforward and WildFig resources [6][7]. Example: “Daily interest updates” (feature) → “I can see progress” (benefit) → “We paid Term 1 fees on time” (milestone).

Can I export or share my investment journey milestones?

Yes. Generate an Annual Wealth Story PDF with selected milestones, notes, and photos. Keep it private by default and use sharing controls for partners or advisors. This compiles automatically from your Wealth Chapters timeline.

How can storytelling improve my consistency, conversions, and retention?

Story-driven features (goal naming, demo proof, milestone notes) increase psychological ownership and motivation, which often correlate with higher engagement and contribution consistency [5][6][7]. For strategic context on storytelling’s business impact, see HBR’s coverage [13]. Pair any claim with anonymized cohort metrics and clear methodology.

Tools and Templates

- Prime vs. Max vs. Child: Printable Comparison Sheet

- Side-by-side summary of fit, tenor, liquidity, and risk

- Includes APR/APY definitions, fee notes, and a QR to live rates on bravewood.ng [8]

- Personalized Bravewood Journey Plan

- Goal naming, payout cadence, and milestone schedule

- Suitability questionnaire, review cadence, and relationship manager contact block

- “Storyworthy Purchase” Worksheet

- Rubric to screen low-meaning buys and redirect to goals

- Quick calculator seeded with typical cost ranges (e.g., energy drinks, video games) [4]

- Annual Wealth Story (Exportable PDF)

- Milestones, deposits/payouts, interest earned, selected notes/photos

- Privacy defaults set to private; granular sharing controls and redaction options

Each template includes methodology notes, version numbers, and update dates.

How to Get Started and Next Steps

Set Up in Minutes: Onboarding Checklist

- Create account and complete KYC (5–10 minutes)

- Set two-factor authentication and security alerts

- Name your first goal and choose tenor/payout cadence

- Fund your account and add your first micro-chapter note

- Schedule a 15-minute check-in after your first payout

Find the latest onboarding steps and support channels on bravewood.ng [8].

Speak to a Relationship Manager

- How to book: use the consult form on bravewood.ng or via official contact channels

- What to prepare: goals, horizon, liquidity needs, and questions about tenor/fees

- What you receive: a documented plan with review dates, plus bios/credentials you can verify via official profiles (e.g., LinkedIn) [9]

Compliance, Disclosures, and Staying Informed

- Review product sheets, fees, and risk disclosures on bravewood.ng [8]

- Verify licensing references in the appropriate CBN registry or guidance page once available [11]

- Check the live rates page and update this plan as tenors/rates evolve

Conclusion

When finance feels mass-produced, it’s forgettable. When it’s yours, it’s memorable—and sustainable. Bravewood’s approach brings clarity to product fit (Prime vs Max vs Child), elevates safety and transparency with CBN-conscious guidance, and turns deposits and payouts into milestones you can see, celebrate, and share. Name your first goal, choose the product that fits, and use the demos and templates to start writing your Wealth Chapters today.

Call to action: Name your first goal, choose Prime/Max/Child with the comparison sheet, and book a free consult with a Bravewood relationship manager to launch your Wealth Chapters journey.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Returns are not guaranteed; capital is at risk and may be subject to tenor and liquidity constraints. Disclosures and assumptions should accompany any performance examples. Verify all licensing and regulatory information directly with official sources. Testimonials reflect individual experiences and do not guarantee similar outcomes.

References

- Investopedia. (n.d.). Mass production. Investopedia. Retrieved from https://www.investopedia.com/terms/m/mass-production.asp

- British Psychological Society. (n.d.). The psychology of stuff and things. British Psychological Society. Retrieved from https://www.bps.org.uk/psychologist/psychology-stuff-and-things

- Van Boven, L., & Gilovich, T. (2003). To do or to have? That is the question. Journal of Personality and Social Psychology. Retrieved from https://psycnet.apa.org/record/2003-06469-004

- Yahoo Finance. (n.d.). 25 little purchases quietly wrecking your budget. Yahoo Finance. Retrieved from https://www.yahoo.com/lifestyle/articles/25-little-purchases-quietly-wrecking-131607327.html

- Pierce, J. L., Kostova, T., & Dirks, K. T. (n.d.). Psychological ownership: A review of the literature. Wiley Online Library. Retrieved from https://myscp.onlinelibrary.wiley.com/doi/10.1002/arcp.1084

- Fassforward. (n.d.). Product storytelling — How to craft powerful product stories with these 6 rules. Retrieved from https://www.fassforward.com/our-thinking/product-storytelling—-how-to-craft-powerful-product-stories-with-these-6-rules

- WildFig Marketing. (n.d.). The best storytelling frameworks for more engaging brand storytelling (+ examples). Retrieved from https://www.wildfigmarketing.com/blog/best-storytelling-frameworks-for-more-engaging-brand-storytelling-examples

- Bravewood. (n.d.). Official site: Products, rates, licensing statement, and FAQs. Retrieved from https://bravewood.ng/

- BravewoodNG. (n.d.). Becoming Bravewood — Our story. LinkedIn Pulse. Retrieved from https://www.linkedin.com/pulse/becoming-bravewood-our-story-bravewoodng-b5z6e

- Ferraro, R., Escalas, J. E., & Bettman, J. R. (n.d.). Possessions and memories. Journal of the Association for Consumer Research (abstract page). ScienceDirect. Retrieved from https://www.sciencedirect.com/science/article/abs/pii/S2352250X20301597

- Central Bank of Nigeria (CBN). (n.d.). About the CBN and regulatory oversight. Retrieved from https://www.cbn.gov.ng/

- Bravewood Blog. (n.d.). Sustain wealth after building it (and related planning resources). Retrieved from https://blog.bravewood.ng/sustain-wealth-after-building-it/

- Monarth, H. (2014). The irresistible power of storytelling as a strategic business tool. Harvard Business Review. Retrieved from https://hbr.org/2014/03/the-irresistible-power-of-storytelling-as-a-strategic-business-tool