Introduction

If you searched “Bravewood” and hit a wall of mixed results, you’re not alone. The name refers to two entirely different things: a Nigerian finance platform and a waterproof hardwood/materials brand. This guide clears the fog with an evidence-led approach: for the finance app, we explain regulation, daily compounding, net-of-fees and inflation results, and risks; for the flooring brand, we map durability claims to recognized ASTM/ISO/NWFA standards and practical, real‑world maintenance. You’ll find a fast brand disambiguation, our long‑term value framework, two deep‑dive hubs (Finance and Flooring), tools and scorecards, case studies, and a decision guide so you can choose confidently.

- Introduction to Bravewood

- Bravewood, Defined: A 30‑Second Disambiguation Hub

- Our Long‑Term Value Framework: Investment vs Enduring Quality

- Bravewood Finance (Nigeria): Is It a Good Long‑Term Investment?

-

Bravewood Flooring: Enduring Quality and Waterproof Performance, Proven

- Waterproof or Water‑Resistant? The Standards and Test Results

- Real‑World Longevity in High‑Traffic and Wet Areas

- Installation Tolerances and Maintenance Schedule

- Bravewood vs LVP, Engineered Wood, and Ceramic

- Warranty Terms, Claim Rates, and What They Signal

- The Enduring Quality Standard and Sustainable Materials Matrix

- FOBO‑Proof Design: Repairability, Parts, and Support Lifecycles

- Tools, Scorecards, and Downloads

- Case Studies and Proof of Performance

- Choose Confidently: The Right Bravewood for You

- Conclusion

- Disclaimer

- References

Bravewood, Defined: A 30‑Second Disambiguation Hub

Bravewood means two distinct offerings. Here’s how to tell them apart and where to go next.

- Bravewood Finance (Nigeria)

- What it is: A savings/investing platform marketed with high annual rates and daily compounding. As of November 2025, Bravewood’s site promotes “earn up to 27% annually,” with daily compounding [1]. Its App Store listing describes a CBN-regulated digital finance product focused on low-risk instruments [2].

- Who it serves: Nigerian savers and long-term investors looking for predictable, cash-like returns and liquidity.

- Proofs to look for: Central Bank of Nigeria (CBN) license status, any SEC Nigeria oversight, and whether deposits/instruments are covered by the Nigeria Deposit Insurance Corporation (NDIC) [17] [15] [16]. Confirm product mechanics, audited statements, and counterparties/custody details in official documents.

- Key risks to assess: Market/credit risk of underlying instruments, platform/custody risk, liquidity/withdrawal timelines, fees, and inflation’s effect on real returns.

- Where to verify: CBN registry (license status) [17], SEC Nigeria investor education (due diligence pointers) [15], NDIC FAQs (coverage scope and limits) [16].

- Contact and support: Use the official “Contact” or “Support” channels listed in the Bravewood app and on bravewood.ng. Response times vary; save confirmations and ticket numbers.

- Bravewood Flooring (Waterproof Hardwood/Materials)

- What it is: A waterproof hardwood/materials line positioned for residential and light‑commercial use, emphasizing durability and indoor air quality.

- Who it serves: Homeowners, builders, and designers specifying flooring for wet or high-traffic spaces (kitchens, baths, entries).

- Proofs to look for: Third‑party lab tests mapped to standards (e.g., ASTM D570 water absorption, ASTM D4060 abrasion), installation and care aligned with NWFA guidance, and indoor air quality certifications (e.g., UL GREENGUARD) [7] [6] [8].

- Key risks to assess: Substrate moisture, installation tolerances, acclimation, ongoing maintenance, and warranty exclusions.

- Where to verify: FSC certificate search for responsible sourcing [13], NWFA homeowner and installer guidance [6], UL GREENGUARD certification program overview [8].

- Contact and support: Use the official brand site’s contact channels for tech datasheets, installation manuals, and warranty registration.

At a Glance: Bravewood Finance vs Bravewood Flooring

- Core offering

- Who it’s for

- Finance: Savers/investors prioritizing liquidity and predictable returns

- Flooring: Homeowners/designers needing wet‑area capable, durable floors

- Primary proofs

- Key risks

- Finance: Market/credit/liquidity/currency risks; inflation erosion; fees

- Flooring: Moisture mismanagement, improper installation, inadequate maintenance

- Protections

- Finance: Possible NDIC coverage for deposits (depends on product structure) [16]

- Flooring: Written warranties (structure/finish/moisture) with stated exclusions

- Next steps

- Finance: Verify licenses and terms, run the ROI calculator, compare to T‑bills/MMFs/net-of-inflation

- Flooring: Review lab reports, confirm site conditions, follow NWFA‑aligned install and care, check certifications and warranty terms

Note: We recommend implementing accurate Organization/Product schema for each entity (legal name, contacts, key documents) and publishing executive bios (e.g., CFA oversight for finance; NWFA‑certified installer or wood technologist involvement for flooring) to strengthen trust signals.

Our Long‑Term Value Framework: Investment vs Enduring Quality

To compare long‑horizon value fairly, we use two lenses:

- Finance lens: compounding mechanics, time‑ vs money‑weighted returns, fees/taxes, inflation, appropriately chosen benchmarks, and risk‑adjusted performance. For definitional clarity on compound interest and investor basics, see U.S. SEC’s Investor.gov resources [3].

- Enduring quality lens: materials provenance, construction/assembly, standardized durability testing (ASTM/ISO), professional installation and care (NWFA), warranty depth, and lifecycle costs [7] [6] [20].

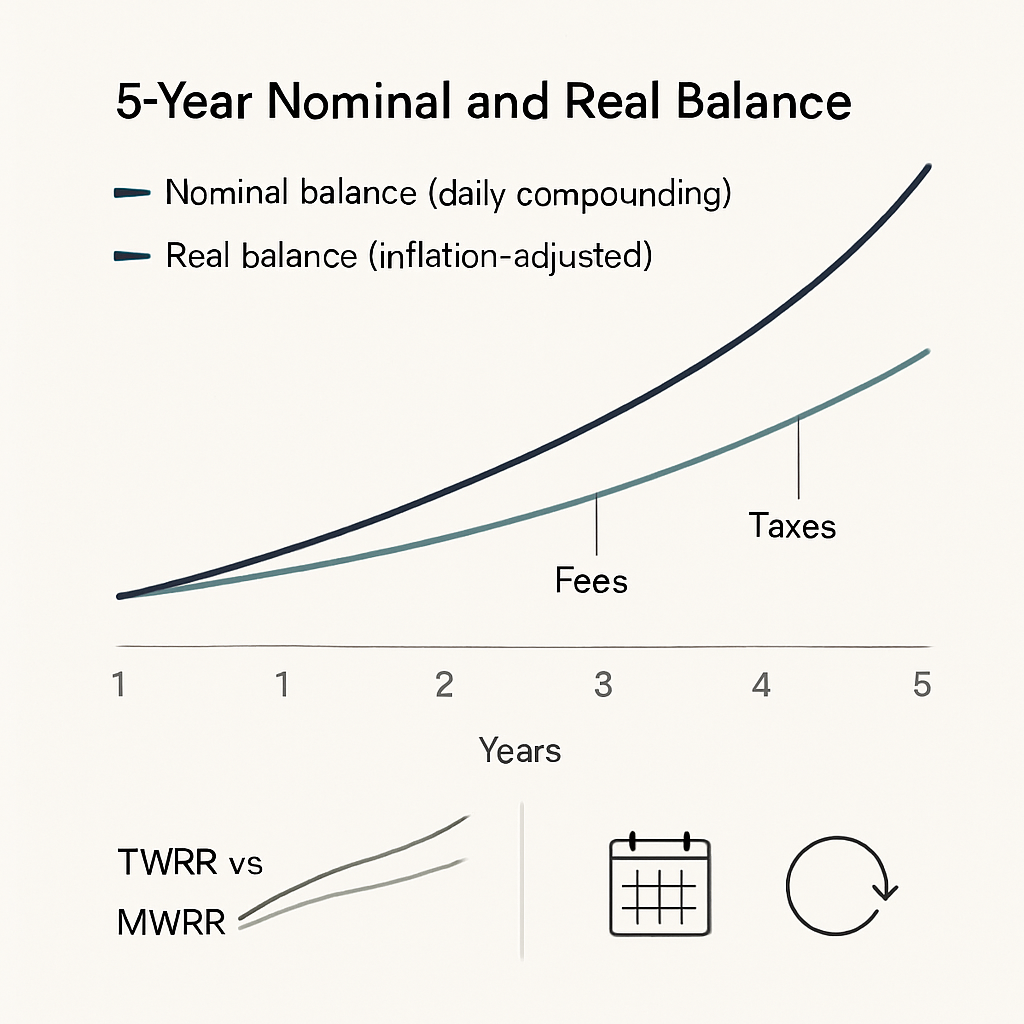

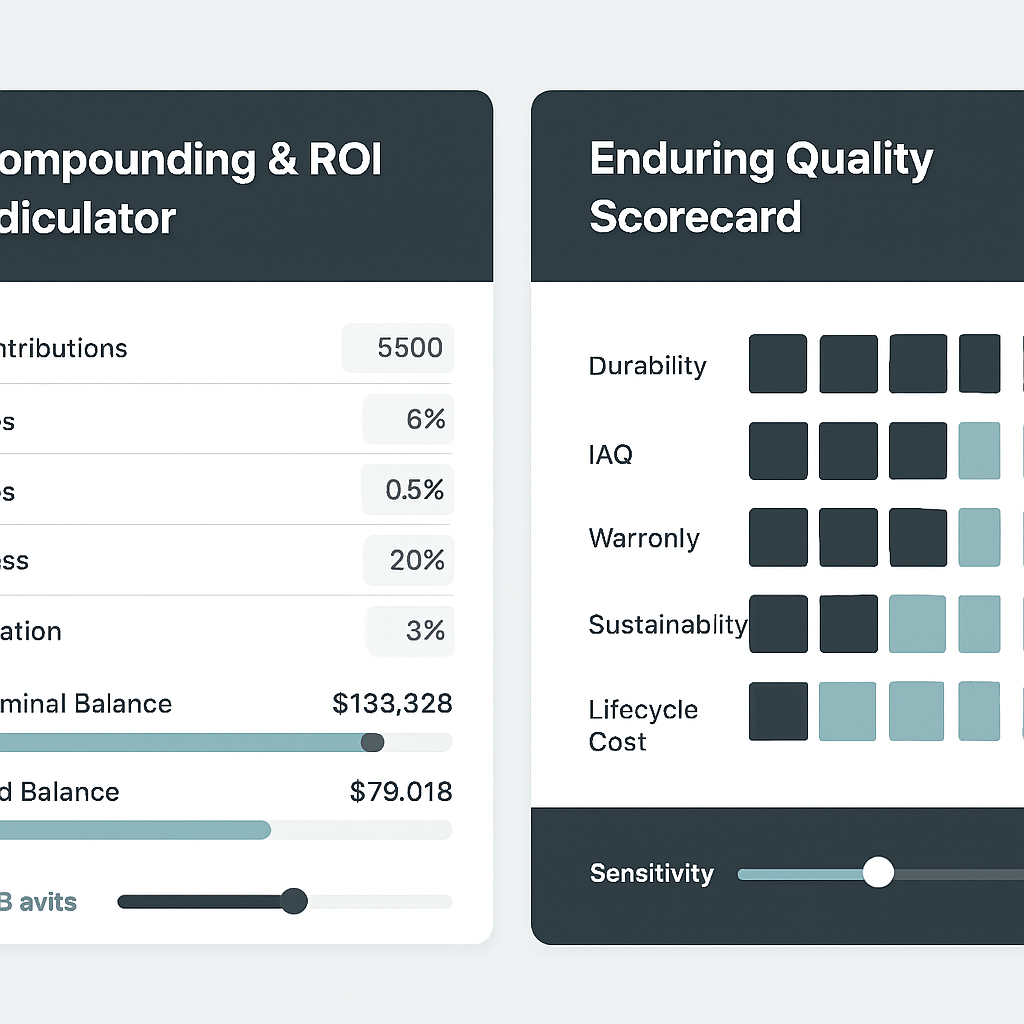

We standardize both with scorecards and calculators:

- Long‑Term Investment Scorecard: verifies regulation, performance methodology (TWRR/MWRR), fee/tax disclosures, liquidity terms, and benchmark comparisons.

- Enduring Quality Scorecard: compiles third‑party test results, install tolerances, maintenance, IAQ certifications, warranty details, and lifecycle cost.

The Long‑Term Investment Lens

- Time‑weighted vs money‑weighted returns: Time‑weighted return (TWRR) isolates manager/platform performance independent of cash‑flow timing; money‑weighted return (MWRR/IRR) reflects your actual cash‑in/cash‑out experience. The CFA Institute’s GIPS standards outline accepted practices for performance reporting [4]. Morningstar’s methodology offers context for risk‑adjusted comparisons (e.g., volatility, downside) [5].

- Compounding frequency: All else equal, more frequent compounding slightly boosts nominal returns. Use realistic assumptions for fees, taxes, and contribution timing; Investor.gov’s compounding primer provides the baseline math [3].

- Inflation and taxes: Focus on real (inflation‑adjusted) returns. Incorporate your likely tax treatment (withholding, income tax) and local inflation readings to avoid overstating outcomes.

- Outputs: We present nominal vs real balances, TWRR/MWRR estimates, and sensitivity scenarios (rate changes, inflation shocks, delayed withdrawals).

The Enduring Quality Lens

- What “enduring quality” means: Durable materials with documented provenance, robust construction/assembly, standardized lab tests for water, abrasion, and dimensional stability, professional installation, maintainability, and proven warranty outcomes.

- Test mapping (examples):

- Practical care: NWFA‑aligned acclimation and moisture management, plus a clear maintenance schedule, determine whether lab performance translates to long service life [6].

Bravewood Finance (Nigeria): Is It a Good Long‑Term Investment?

We turn marketing claims into verifiable facts and decision‑ready comparisons.

Regulatory Status and Investor Protections

- What to verify

- CBN license status: Confirm the exact licensed entity name and license category in the CBN registry [17].

- SEC Nigeria: Determine if the platform or any product falls under SEC oversight (e.g., collective investment schemes) and review investor protection guidance [15].

- NDIC coverage: NDIC insures bank deposits, not all financial products; verify whether your funds are deposits at an insured bank or exposed to other instruments outside NDIC coverage [16].

- Claim origins: Bravewood’s site advertises “up to 27% annually,” compounded daily (accessed November 2025) [1]. Its App Store listing frames the product as CBN‑regulated with low‑risk instruments [2]. Validate these claims via regulator lookups and official documents before funding.

Ownership, Custody, and Audits

- Review these disclosures prior to investing:

- Corporate ownership and registered addresses (company names as licensed)

- Where client funds are held (custodians, segregated accounts), and counterparties

- Independently audited financial statements and any third‑party security attestations

- Clear customer service channels (email, phone) and escalation paths

Maintain personal records of downloaded statements and confirmations.

How Daily Compounding Works (Assumptions, Math, and Sensitivities)

- The basics: Daily compounding grows your balance by applying a daily periodic rate (annual nominal rate divided by compounding days) to principal plus accrued returns. Real outcomes depend on:

- Contribution timing (start/end of period), reinvestment, and any withdrawals

- Platform and withdrawal fees

- Taxes (withholding/income), and inflation

- Example approach:

- Nominal growth: A = P × (1 + r/365)^(365t), where r is annual nominal rate, t in years

- Real growth: Adjust the nominal balance by cumulative inflation to estimate purchasing power

- Sensitivities: Recalculate for rate bands (e.g., ±300 bps), fee changes, or delayed withdrawals

- For methodology alignment and a primer on compound interest, see SEC’s Investor.gov resources [3].

Fees, Taxes, and Net‑of‑Inflation Results

- Fees: Common charges include platform/admin fees, custodial or transfer fees, and withdrawal penalties for early access. Always evaluate net returns after all fees.

- Taxes: Consider the applicable tax regime for interest/returns. Withholdings can reduce the amount available for compounding.

- Inflation: Nigerian inflation materially affects real outcomes. Use the latest CPI readings from the National Bureau of Statistics (NBS) to convert nominal to real returns [21].

- Presenting results: Show 1‑, 3‑, and 5+‑year scenarios with:

- Nominal vs real balances

- Net of fees/taxes vs gross

- Methodology notes (cash‑flow timing, compounding assumptions, and data sources)

Risks and Scenario Analysis

- Risk categories (outline)

- Market/interest‑rate risk: Underlying instruments may reprice as rates change

- Credit/counterparty risk: Issuer or counterparty default/delay risk

- Liquidity risk: Withdrawals may be delayed depending on instrument liquidity

- Currency/inflation risk: Purchasing power erosion and FX exposure (if any)

- Scenarios: Provide best/base/worst cases with documented assumptions, including rate paths, fee/tax changes, and withdrawal timing. CFA Institute frameworks and professional risk categorizations offer a helpful organizing lens [4].

- ROI caveats: ROI can obscure timing effects and risk—use TWRR/MWRR and risk metrics for fairer comparisons [12].

Benchmarks and Comparisons: T‑Bills, MMFs, Bank Deposits

- Why benchmarks matter: Compare Bravewood’s stated or realized returns against:

- Documentation: Label charts with data sources and dates for each benchmark series, and keep scales consistent for apples‑to‑apples comparisons [22] [21].

Minimums, Liquidity, and Withdrawal Terms

- Before you fund, confirm:

- Minimum investment and top‑up rules

- Any lock‑ups, notice periods, and cut‑offs for withdrawal requests

- Fees for instant vs standard withdrawals, expected timelines, and holidays/weekend processing

- Tip: Keep a simple withdrawal checklist—request, confirmation, settlement date, and bank receipt—and test a small redemption early.

Due Diligence Checklist and Red Flags

- Verify in minutes:

- CBN license (entity name matches your app/account) [17]

- Any SEC Nigeria oversight relevant to the product type [15]

- NDIC applicability (is it actually a deposit at an insured bank?) [16]

- Audited financials and named custodians/counterparties

- Performance methodology (TWRR/MWRR), net‑of‑fees/taxes results, and inflation adjustments

- Fees/penalties and documented withdrawal timelines

- Support quality: reachable contacts, SLA expectations, and escalation path

- Red flags: Unverifiable licenses, opaque underlying instruments, guaranteed “too‑good‑to‑be‑true” returns, or resistance to providing audited statements.

Investor FAQs: Straight Answers

- Is Bravewood regulated? Verify license status in the CBN registry and review any SEC Nigeria applicability (product dependent) [17] [15].

- How does daily compounding work? Returns apply each day to your balance; actual results depend on fees, taxes, and your cash‑flow timing. See our calculator and Investor.gov’s primer [3].

- What risks matter most? Market/credit/liquidity risks can affect access and outcomes; inflation affects real returns.

- What are the minimums and withdrawals like? Check the official terms for minimums, lock‑ups (if any), processing cut‑offs, and fees. Test a small withdrawal early.

- How does it compare to T‑bills/MMFs/deposits? Benchmark against tenor‑matched T‑bills, MMFs, and deposit rates, net of fees and inflation—using consistent methodology [22] [21].

Bravewood Flooring: Enduring Quality and Waterproof Performance, Proven

We translate claims into standards‑backed tests, professional installation/maintenance, fair comparisons, and transparent warranty expectations.

Waterproof or Water‑Resistant? The Standards and Test Results

- Definitions matter: “Waterproof” implies resistance to water ingress under specified conditions; “water‑resistant” often indicates limited protection. Always examine test methods, exposure time, and pass/fail criteria.

- Core tests to request and review

- Water absorption/ingress: ASTM D570—quantifies moisture uptake under controlled immersion [7]

- Abrasion resistance: ASTM D4060—Taber abrasion cycles with standardized wheels/loads [7]

- Dimensional stability: Applicable ASTM/ISO methods for moisture/thermal cycling [7] [20]

Waterproof Claims, Tested: D570, D4060, Stability - Third‑party labs: Prefer independent labs (e.g., UL, Intertek, TÜV) and include chain‑of‑custody notes. Ensure reports are date‑stamped and downloadable [8].

- Read the fine print: Confirm test conditions (duration, temperature, edges sealed/unsealed) and ensure the product SKU you’re buying matches the tested sample.

Real‑World Longevity in High‑Traffic and Wet Areas

- What to document in case studies:

- Location: kitchen, bath, laundry, entry

- Traffic profile: household size, pets, footwear habits

- Moisture tracking: periodic moisture‑meter readings at fixed points (month 1, 6, 12, 24+)

- Maintenance logs: cleaning products/frequency, spill response time

- Failure mode analysis: If issues arise (edge swelling, finish wear, cupping), record root causes and corrective actions (humidity control, refinishing, board replacement). HUD’s “Durability by Design” offers a practical lens on moisture and detailing in the built environment [9].

- Buyer takeaway: Good lab performance must be paired with correct installation and maintenance to realize the promised service life.

Installation Tolerances and Maintenance Schedule

- Installation essentials (align with NWFA guidance):

- Acclimation: Follow manufacturer/NWFA specifications for time, temperature, and RH [6]

- Substrate: Flatness tolerances, moisture content verification, and appropriate underlayment/moisture barriers

- Perimeter: Expansion gaps and transitions as specified

- Maintenance cadence (example):

- Daily/weekly: Dry dust or microfiber; damp mop with manufacturer‑approved cleaner

- Quarterly: Inspect joints/edges; address minor finish wear proactively

- Annually: Deeper clean/refresh; reassess humidity control and furniture pads

- Warranty preservation: Keep installation photos, moisture readings, and maintenance logs—these often determine claim outcomes [6].

Bravewood vs LVP, Engineered Wood, and Ceramic

- Compare on a single, standardized grid:

- Waterproofing and moisture response (ASTM/ISO methods) [7] [20]

- Abrasion cycles to endpoint (ASTM D4060) [7]

- Dimensional stability across humidity swings

- IAQ: Low‑VOC and UL GREENGUARD certifications [8]

- Maintenance burden and refinishing options

- Lifecycle cost: materials + install + maintenance + expected replacement interval

- Sustainability: FSC sourcing, EPDs, and relevant LEED credit contributions [13] [14]

- Be transparent: Disclose test conditions, wheel types/loads for abrasion, and exposure durations so results are apples‑to‑apples.

Warranty Terms, Claim Rates, and What They Signal

- What to decode:

- Length and scope: structural, finish, moisture/installation‑related exclusions

- Registration requirements and transferability

- Claim stats: anonymized claim rates by failure mode and average resolution time

- Signals of strength: Longer coverage with clear, fair exclusions and low claim rates—paired with responsive support—are strong confidence markers. Publish annualized warranty summaries for transparency.

The Enduring Quality Standard and Sustainable Materials Matrix

- Our quality scorecard consolidates:

- Materials provenance: FSC certification and chain of custody [13]

- Construction/assembly details (core construction; surface treatments)

- Finish durability: standardized abrasion/chemical resistance

- Repairability: board replacement options, finish refresh/refinish pathways

- IAQ: UL GREENGUARD or equivalent [8]

- Lifecycle cost and embodied carbon: EPDs and LEED‑aligned disclosures [14]

- Deliverables: A downloadable matrix with durability scores, certifications, and lifecycle cost assumptions, plus links to verifiable certificates.

Heritage‑Grade Craftsmanship: What It Means and How to Verify

- Criteria to look for:

- Wood selection: quarter‑sawn/seasoned materials for stability

- Joinery and assembly: techniques that permit repair and limit stress concentration

- Hand‑finished or controlled finishing that can be refreshed over time

- Verification:

- Why it matters: Heritage‑grade methods often increase repairability and long service life, lowering total cost of ownership.

FOBO‑Proof Design: Repairability, Parts, and Support Lifecycles

- The concern: Fear of becoming obsolete (FOBO) isn’t just for jobs; consumers worry products will date quickly. The World Economic Forum, citing Gallup data, notes a sizeable share of workers worry about tech‑driven obsolescence—an anxiety that spills into purchase decisions [10].

- What to publish and guarantee:

- Support timelines (years of documentation/updates)

- Parts availability windows and compatible substitutes

- Service manuals for owners/installers

- Trade‑in/resale pathways where applicable

- Practical effect: Clear support lifecycle policies reduce obsolescence risk and bolster long‑term value.

Tools, Scorecards, and Downloads

Centralize calculators and datasets so you can validate long‑term value yourself. Each tool includes a versioned methodology note, data sources, and an update timestamp.

Compounding and ROI Calculator (Net of Fees, Taxes, and Inflation)

- Inputs: Contribution schedule (lumps/sips), nominal rate and compounding, fee/tax assumptions, and inflation path.

- Outputs: Nominal vs real balances, TWRR/MWRR estimates, and sensitivity analysis across rate/inflation/fee bands.

- Methods: Aligned with Investor.gov’s compounding principles; transparent formulas and limitations are included in the methodology note [3].

Enduring Quality Scorecard and Lifecycle Cost Calculator

- Inputs: ASTM/ISO/NWFA test results, warranty terms, IAQ certifications (e.g., UL GREENGUARD), FSC/EPD data, and maintenance intervals [7] [6] [8] [13] [14].

- Outputs: A single durability score (with sub‑scores), lifecycle cost over 10–20 years, and sustainability indicators.

- Assets: Editable templates and example datasets (CSV) provided with timestamps.

Case Studies and Proof of Performance

We pair longitudinal data with third‑party verification where possible—and make raw datasets downloadable.

Finance: Transparent Rate History vs Benchmarks

- What you’ll see: Bravewood’s stated rate history (as disclosed) charted against tenor‑matched Nigerian T‑bills, MMF averages, and bank deposit rates, plus inflation for real‑return context [22] [21].

- Methods: Documented sources, update cadence, and code/notes to replicate calculations. Stress tests illustrate how rate and inflation swings affect outcomes.

Flooring: Time‑Lapse Waterproofing and Abrasion Tests

- What you’ll see: Standardized lab results (ASTM D570, D4060, dimensional stability protocols), plus field tests simulating spills, humidity cycles, and traffic wear over months/years [7].

- Methods: Chain of custody and lab identities, environmental conditions, and maintenance logs so results are reproducible and comparable.

Choose Confidently: The Right Bravewood for You

Who are you, and what do you need to verify before committing?

If You’re an Investor

- Quick checklist:

- Confirm CBN license and entity names match the app/account [17]

- Check whether any SEC Nigeria oversight applies and read investor resources [15]

- Determine NDIC applicability (is your money a bank deposit or another instrument?) [16]

- Read audited statements and identify custodians/counterparties

- Run our ROI calculator with conservative rates, full fees/taxes, and current inflation [21]

- Compare net‑of‑inflation outcomes to T‑bills/MMFs/deposits using consistent methods [22]

- Diversify appropriately and consider independent advice as needed

- Save everything: Keep PDFs of terms, statements, and withdrawal confirmations.

If You’re a Homeowner/Designer

- Quick checklist:

- Review third‑party test reports (ASTM D570/D4060, stability), confirm they match your SKU [7]

- Verify install conditions and tolerances; align with NWFA guidance [6]

- Understand maintenance cadence and approved products; set humidity controls

- Confirm warranty terms, exclusions, registration, and transferability

- Check sustainability and IAQ: FSC certificate search, UL GREENGUARD listings, EPDs/LEED contributions [13] [8] [14]

- Use our Enduring Quality scorecard and lifecycle cost calculator to compare options over 10–20 years

Conclusion

One name, two worlds—this guide helps you navigate both with proof, not hype. For Bravewood Finance, you can verify regulation, understand daily compounding, and compare net‑of‑inflation results against trusted benchmarks. For Bravewood Flooring, you can map “waterproof” and durability claims to ASTM/ISO/NWFA standards, align installation and care, and evaluate warranties and sustainability. Use the checklists, calculators, and scorecards to turn marketing into measurable confidence—and choose the Bravewood that truly fits your long‑term goals.

Disclaimer

This article is for information only and does not constitute investment advice. Returns are not guaranteed and may vary. Verify all regulatory licenses and terms directly with the relevant authorities. Product performance depends on correct selection, installation, and maintenance; consult qualified professionals and review full warranty terms.

References

- Bravewood. (N.D.). Bravewood Nigeria – official site (accessed Nov 2025). https://bravewood.ng/

- Apple Inc. (N.D.). Bravewood: Earn, Invest, Grow (App Store listing). https://apps.apple.com/us/app/bravewood-earn-invest-grow/id6450634755

- U.S. Securities and Exchange Commission. (N.D.). Introduction to Compound Interest. Investor.gov. https://www.investor.gov/introduction-investing/investing-basics/compound-interest

- CFA Institute. (N.D.). Global Investment Performance Standards (GIPS). https://www.cfainstitute.org/en/ethics-standards/codes/gips-standards

- Morningstar Research. (N.D.). Morningstar Rating Methodology. https://www.morningstar.com/research/signature-methodologies/morningstar-rating

- National Wood Flooring Association (NWFA). (N.D.). Homeowner Resources and Care. https://www.woodfloors.org/consumer.aspx

- ASTM International. (N.D.). Standards Directory (including D570 water absorption; D4060 abrasion). https://www.astm.org/standards/

- UL Solutions. (N.D.). UL GREENGUARD Certification Program. https://www.ul.com/resources/ul-greenguard-certification-program

- U.S. Department of Housing and Urban Development. (N.D.). Durability by Design: A Guide for Residential Builders. https://www.huduser.gov/portal/publications/durability_by_design.pdf

- World Economic Forum. (2023). AI and FOBO: Jobs anxiety explained (citing Gallup). https://www.weforum.org/stories/2023/12/ai-fobo-jobs-anxiety/

- Sun, Y., Bellezza, S., & Paharia, N. (2021). Consumer Durability Neglect. Journal of Marketing (preprint PDF). https://business.columbia.edu/sites/default/files-efs/citation_file_upload/Sun%20Bellezza%20Paharia%202021.pdf

- Investopedia. (N.D.). Return on Investment (ROI). https://www.investopedia.com/terms/r/returnoninvestment.asp

- Forest Stewardship Council (FSC). (N.D.). FSC Certificate Search. https://search.fsc.org/

- U.S. Green Building Council. (N.D.). LEED – Leadership in Energy and Environmental Design. https://www.usgbc.org/leed

- Securities and Exchange Commission (Nigeria). (N.D.). Investor Education. https://sec.gov.ng/investor-education/

- Nigeria Deposit Insurance Corporation (NDIC). (N.D.). Frequently Asked Questions. https://ndic.gov.ng/frequently-asked-questions/

- Central Bank of Nigeria. (N.D.). Lists of Licensed Financial Institutions. https://www.cbn.gov.ng/Supervision/finstitutions.asp

- Heritage Crafts Association (UK). (N.D.). About Heritage Crafts. https://www.heritagecrafts.org.uk/

- UNESCO. (N.D.). Intangible Cultural Heritage. https://ich.unesco.org/

- International Organization for Standardization (ISO). (N.D.). Standards Catalogue. https://www.iso.org/standards.html

- National Bureau of Statistics (Nigeria). (N.D.). Inflation (CPI) Data Portal. https://nigerianstat.gov.ng/elibrary?queries=inflation

- Central Bank of Nigeria. (N.D.). Government Securities Yields (T‑Bills). https://www.cbn.gov.ng/rates/govtsecurities.asp